In the spirit of open enrollment, many Americans are signing up for health insurance now for next year. Health insurance can be a painful monthly payment for many. Premium payments can be as much as a car or mortgage. The silver lining is medical costs can often be tied to a tax deduction for many.

Health related costs being deductible

Health insurance premium costs as an employee

As an employee, your health insurance costs will show up on your W-2. You cannot deduct in any way the portion your employer paid for you. You can also not deduct it if your health insurance premium payment was made through payroll using pre-tax dollars. Using this premium cost to try and make a deduction on your return would be a double tax benefit. Now if you were an employee and paid with after-tax dollars health insurance premiums these costs would fall into the itemized deduction medical and dental expenses

Itemized deductions for medical and dental expenses

The itemized deductions for medical and dental expenses are the IRS’s way of giving everyone a shot at deducting their medical costs now it comes with caveats. You have to itemize your deductions using Schedule A which is increasingly fewer people due to the higher standard deduction. The other caveat is you can only deduct the medical and dental expenses that exceed 7.5% of your adjusted gross income (AGI). The IRS also has a published pub 502 to give specific guidance on what is considered a qualified health insurance expense

Example

To walk through an example, your adjusted gross income is $50,000 and your total health insurance premium costs for the year are $3,000. You had various qualified health expenses throughout the year that total $2,000.

Answer:

$50,000 AGI * 7.5% = $3,750 this is the amount your medical expenses must exceed before you can claim them as a deduction.

$3,000 + $2,000 = $5,000 total qualified medical expenses for the year

$5,000 – $3,750 = $1,250 is the total amount you can deduct on your schedule A of your tax return for the year

Health insurance premiums being self-employed

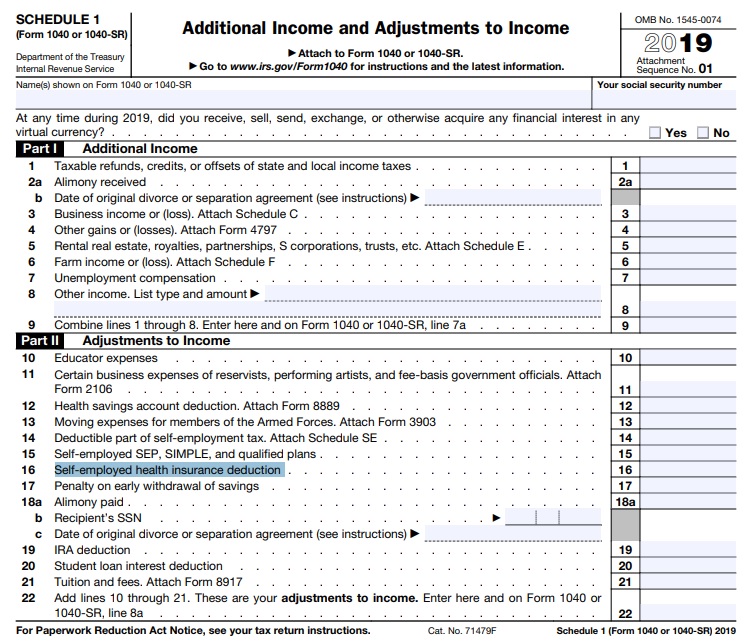

When you are self-employed you get the full brunt of having to pay for your health insurance which can be a costly decision. Fortunately, self-employed individuals get exempt from the 7.5% rule and you do not need to itemize your deductions to take advantage of deducting your health insurance premiums. If you plan to deduct your health insurance premiums as a self-employed business owner you cant be simultaneously eligible to participate in another employer plan that is either yours or your wife. Also, this deduction is for self-employed individuals if you have a S-Corp your health insurance premiums will be on your W-2. You can deduct your premiums directly for you, your spouse, and dependents on Schedule 1 Line 16 which will flow through to your 1040.

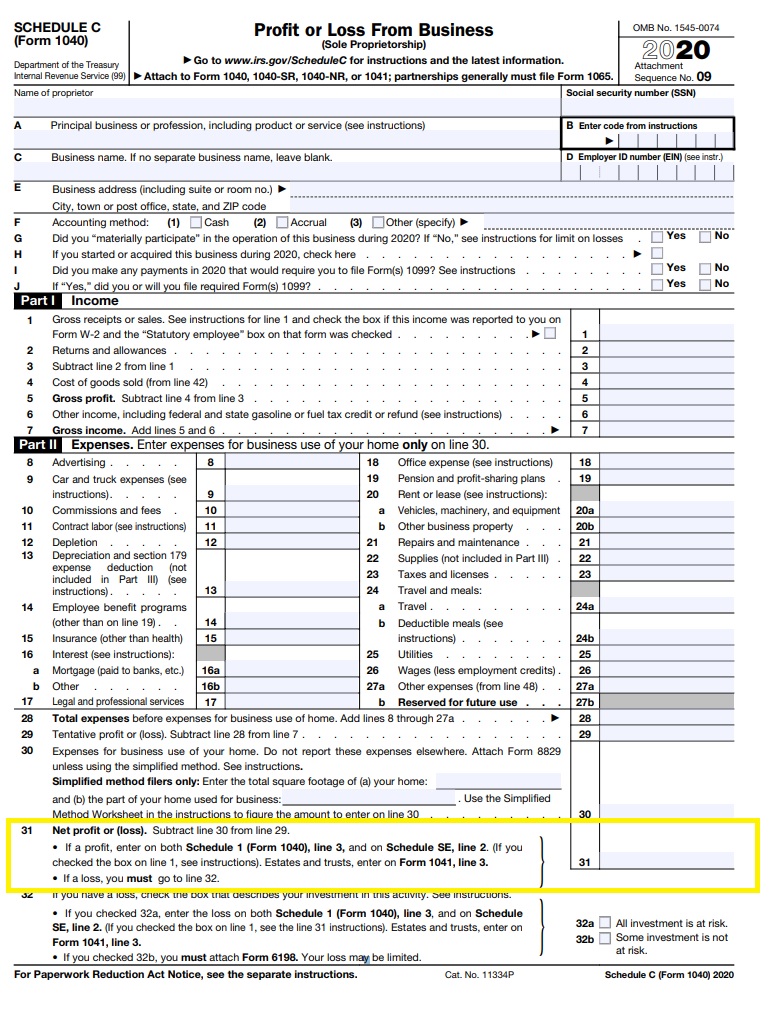

If your health insurance premium costs are greater than your net profit on Schedule C you are limited to taking a deduction up to the full amount of your net profit. Your net profit can be found on Schedule C Line 31. Also, if you receive a subsidy on your health insurance by purchasing it on the exchange you cannot deduct this part of the insurance, you must deduct the net cost of the premiums to you otherwise that would be a double benefit. The IRS doesn’t like giving double benefits out, they think a single benefit is charitable enough.

Health insurance for the self employed with a S-Corp

When your self employed but have a S-Corp it is a bit more complicated to deduct your health insurance but all is not lost! When owning and operating a S-Corp you receive a W-2 from the S-Corp you own. You need to add these wages to your W-2 in Box 1 just like any other ordinary taxable wages you make. Next you get to deduct this special expense on your personal tax return on Form 1040. For your employees the benefit paid out to them will be considered a fringe benefit and deductible for you as the owner as well

Supercharging your health-related deductions

Health insurance premiums is only part of the story. If you have a High Deductible Health Plan (HDHP) you can supercharge your deductions much more with an HSA. I wrote an article previously that dives deeper into HSA’s if you have High Deductible Health Plan (HDHP) already and are looking to increase your tax deductions.

sources:

https://www.irs.gov/publications/p535#en_US_2019_publink1000208843