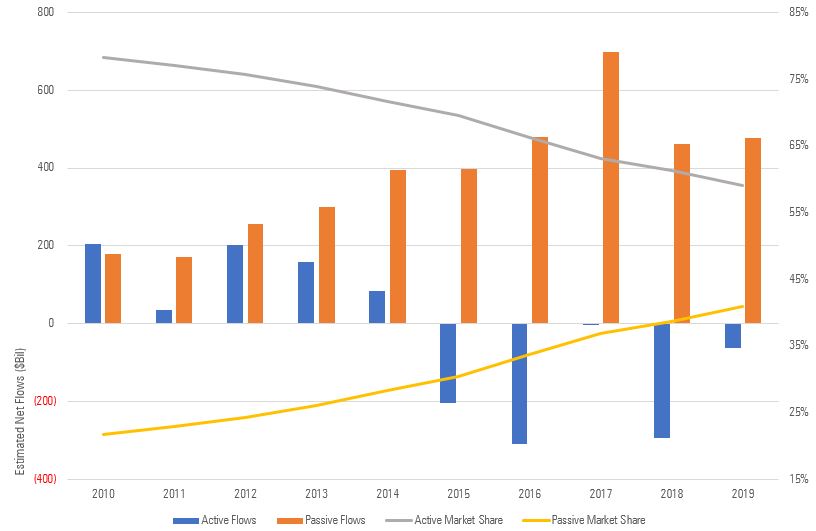

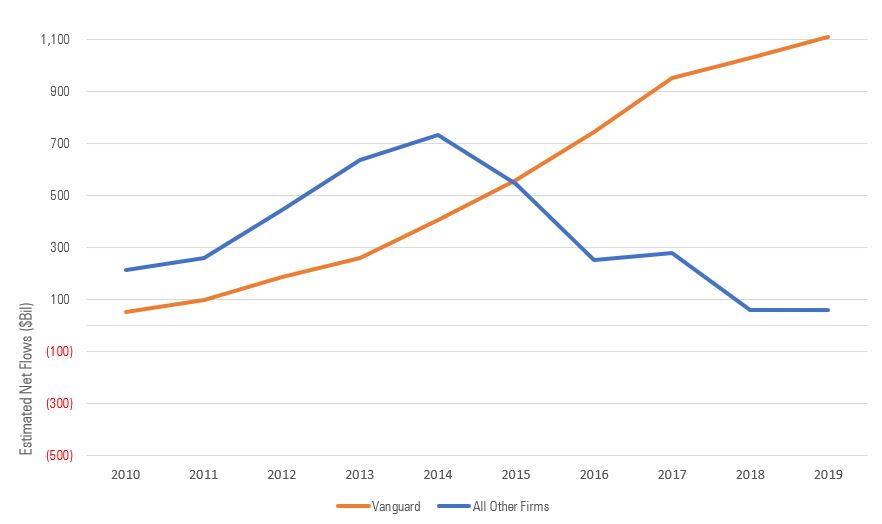

The rise of passive investing is undeniable. Fund flows towards passive investment vehicles have been on the steady incline for years now. The size of Vanguard reflects this as one of the largest passive managers around that originally ignited the flames of passive investing. Passive investing is defined by Investopedia as

“Passive investing is an investment strategy to maximize returns by minimizing buying and selling. Index investing in one common passive investing strategy whereby investors purchase a representative benchmark, such as the S&P 500 index, and hold it over a long time horizon.”

Investopedia

So as an example, if you take the S&P 500 index which is an index created by S&P Dow Jones Indices and you use that as the selected benchmark. Then you buy a mutual fund or ETF that tracks or matches the performance as closely as possible to that index and you sit on it you are by definition a passive investor. Phrases like “active management is dead” or “active investing can’t outperform passive investing net of fees” have become the mantra of many discussions and the subject of many debates. What is interesting is if we say passive investing is simply buy and hold, what exactly are we buying and holding?

There are approximately 5,000 indexes just in the US alone which represent all different areas of the market. So you say alright I’m going to buy S&P 500 as it is the most widely quoted index it represents about 80% of the US stock market and many of the companies have international revenues and therefore are correlated to the global stock market.

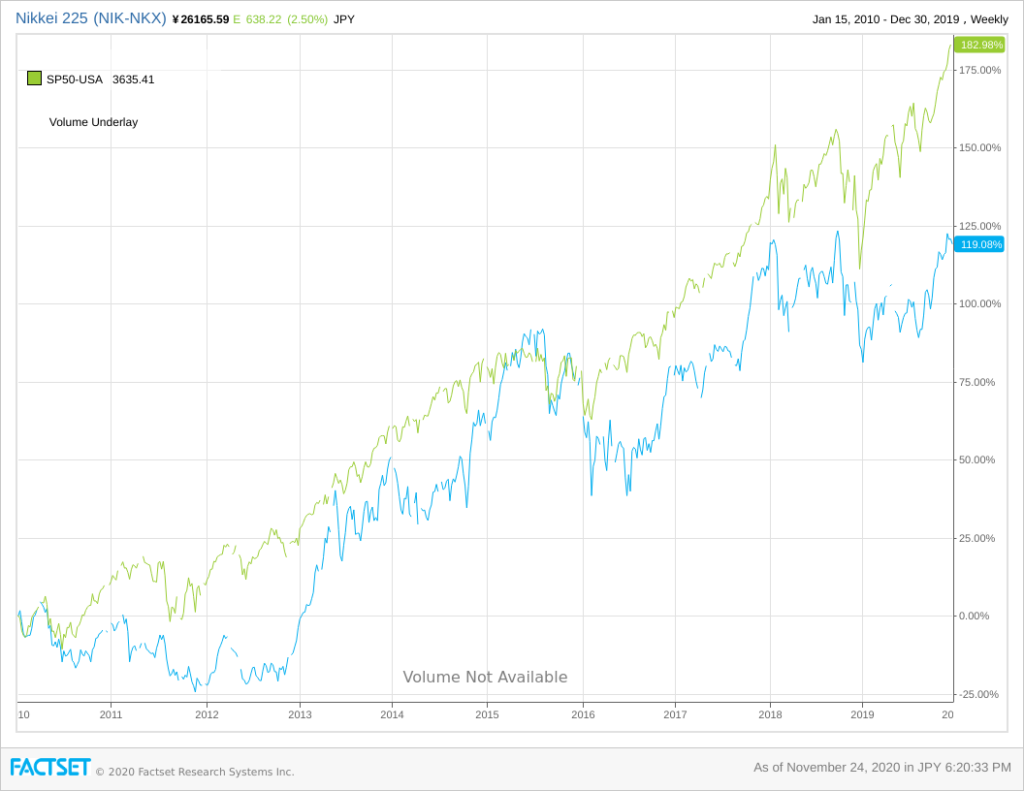

Well, the first problem with that is let’s say you are a Japanese investor the household names you grew up with maybe companies like SoftBank, Toyota, Nippon Telegraph, and Telephone. While there may be some overlap, there are probably a lot of companies that are not the same as someone who grew up in the United States or Europe. The most widely quoted index when you turn on the TV is the NIKKEI 225. You buy an index fund that tracks the NIKKEI 225 and over the last 10 years from 2010-2020, your return is 119%, while the S&P 500 return is 183%. Both people are considered 100% passive but their investment outcomes are drastically different.

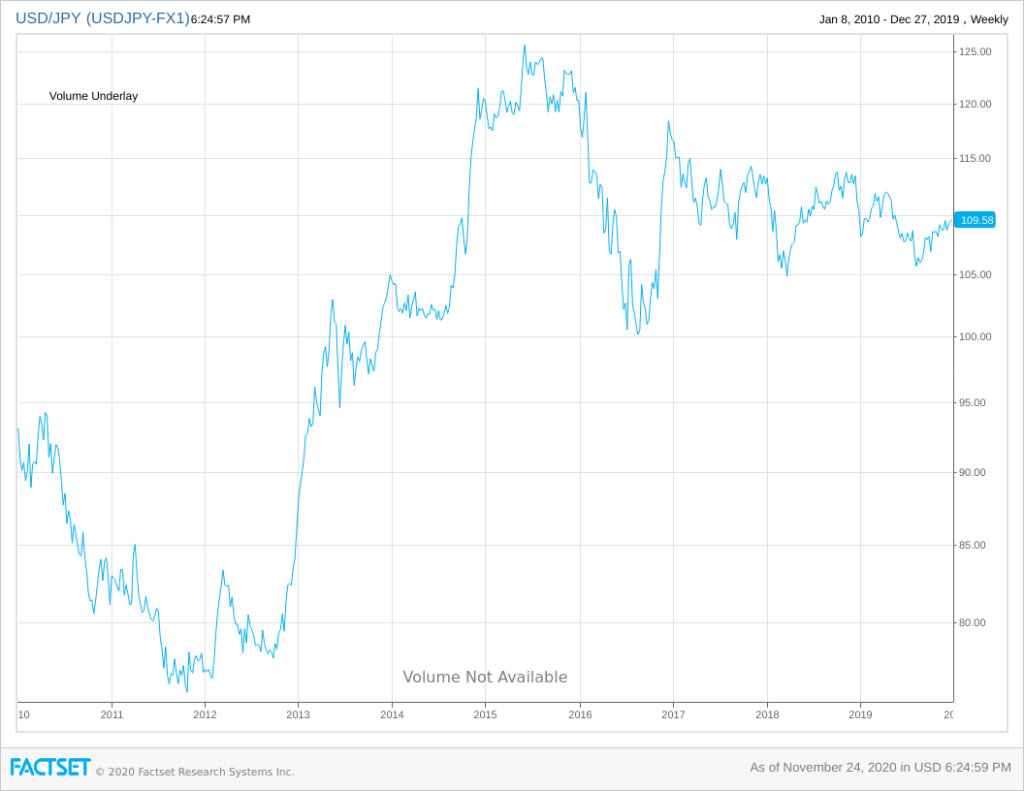

You may at this point be saying well everyone should own the S&P 500 since America is the best nation around. While the US stock market has done fantastically well the last decade it wasn’t the best performing stock market the last decade. Also, there have been decades where the US stock market largely underperformed other stock markets around the world. There’s another issue a foreign investor has buying the S&P 500 and that’s the effect of currency returns. If our Japanese investors buy the S&P 500 and decide to hedge their return in their local currency their return will be the same as a U.S. investor + or – any currency returns. for the 2010 – 2020 period, the Japanese investor would have realized about a 30% lower return due to the Dollar strengthening relative to the Japanese Yen over that period.

Over the long run currency returns should all equal to zero but that could take decades and someone may not have that long of a time horizon. The alternative is the Japanese investor can leave their position un-hedged opening them to currency risk. A investor now has to think of a entirely separate moving part and problem leaving it un-hedged and if they do hedge they are making an active decision that can have a big impact.

Passive investing has allowed investors to have simplicity and transparency in investing but it certainly has not taken out the creativity and art of investing with thousands of investment vehicles that are all grouped under the philosophy of passive investing to choose from.

sources:

https://www.morningstar.com/insights/2020/01/29/fund-flows-recap