Hundreds if not thousands of people don’t know how their financial advisor or stockbroker gets paid. If you ask these people many will shrug and assume the advice they are getting is free. I’m sure their financial advisor or stockbroker is a nice girl or guy but they can’t show up every day wearing a suit and putting their kids through school on just being nice they have to get paid somehow. I will use the term financial advisor and stockbroker interchangeably in this article as many stockbrokers that get compensated as a broker still hold themselves out to the public as a financial advisor.

There are two primary ways a financial get paid on managing someone’s money. The first is the stated amount this can be a percentage of the assets managed or the performance on the investments. The other method is not stated there is no need to discuss it as the financial advisor gets paid for placing the investor’s money in an investment product and receiving a commission. The top question investors ask about the commission method is won’t they see the charge on their statement? The answer is No since the commission is already embedded in the product.

I will illustrate using an American Funds mutual fund as an example. I have absolutely nothing against American Funds and American Funds has some great investment funds this example is simply to illustrate how the industry pays financial advisors commissions.

Mutual Fund Classes

Before we understand how an advisor takes commissions, we need to understand the difference between different mutual fund share classes. When a fund company in this case American Funds creates a mutual fund, they create different fund share classes of the same fund. The different share classes own and invest in the same exact investments the only difference is the expense ratio of these share classes. These different share classes therefore should perform identically in performance net of the difference in fees. Mutual fund share classes are not to be confused with stock share classes. When a stock issues multiple share class types the difference often has to do with the voting rights. For mutual funds, the different share classes have different expense ratios attached to them depending on the distribution channel they are put in for the public to invest in them.

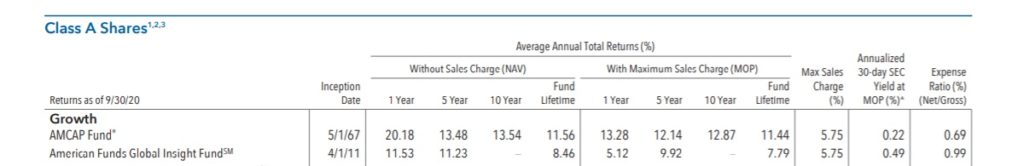

Class A Shares

In the table below labeled Class A Shares we are looking at the performance of two mutual funds the AMCAP Fund & American Funds Global Insight Fund specifically for investors that held the Class A shares. The Average Annual Total Return section is broken into two sections a Without Sales Charge (NAV) and With Maximum Sales Charge (MOP). The Without Sales Charge (NAV) columns is the net performance after all the performance of the investments are added up liabilities are subtracted and divided by the total shares the fund has. The With Maximum Sales Charge (MOP) is the net performance of the fund after both the expense ratio and the Max Sales Charge column is netted from the performance. The Max Sales Charge is a one-time upfront charge what we call a commission. The performance difference between the Without Sales Charge column and With Maximum Sales Charge should only be different by the 5.75% commission. You can see the difference is not exactly the upfront commission difference as there are a variety of other factors but the difference is close. For the rest of our example, we are going to use the performance column With Maximum Sales Charge (MOP) to compare the Class A share to the other share classes.

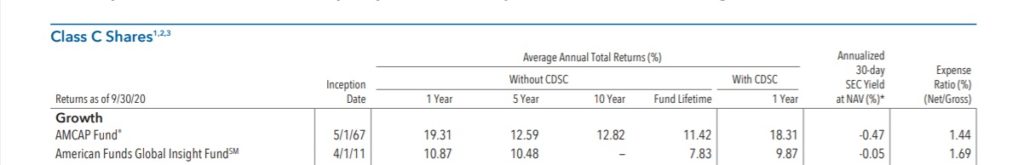

Class C Shares

As we move on to the Table with Class C Shares, we see the Max Sales Charge column disappear. This column disappears since there is no upfront commission for purchasing this share class. However, the annual Expense Ratio column has increased instead. This shift in expense ratio is moving the financial advisor’s pay from the upfront commission to the ongoing Expense Ratio. An important difference to note with the Class C share is there is a column labeled With CDSC. CDSC stands for Contingent Deferred Sales Charge and is a penalty on an investor’s money if they sell their investment too quickly. You can take the performance difference of the 1-year column with CDSC and without CDSC to see the Contingent Deferred Sales Charge (CDSC) on this investment is 1%.

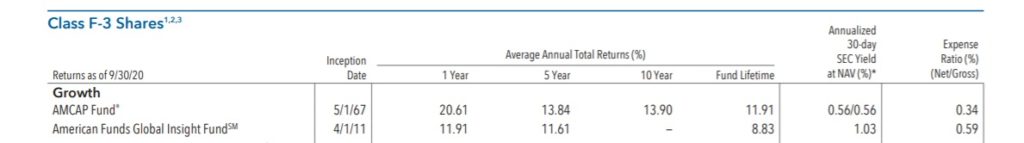

Institutional Share Class

The last share class we will look at is the Class F-3 Shares. You can immediately notice the expense ratio is the lowest of the 3 share classes and there is no upfront commission of CDSC fee for this share class. The added Expense Ratio fee for the other share classes is called a 12B-1 fee it is the ongoing fee the financial advisor gets paid from the mutual fund company. Mutual fund share classes like the American Funds F-3 Share Class that are the cheapest share class of the mutual fund are often called institutional share class funds.

How do advisors determine which share class to sell?

A financial advisor that is receiving a commission can only sell the Class A share or the Class C share since they will not get paid anything for selling the F-3 share. It is for that reason advisors that sell institutional mutual funds like the F-3 share class that doesn’t have embedded advisor fees must charge a client some other way discussed with the client. In our example, if you throw the F-3 share class out and narrow the choices to the remaining two share classes there are still two choices. The idea behind a financial advisor selling a Class A Share rather than a Class C Share is for long-term investors the total fees will be cheaper since the ongoing expense ratio is less. However, in reality, it is common for many investors to change their mutual fund holdings through time, and purchasing another Class A Share fund usually generates another commission. All these commission calculations are performed by the fund company internally so when an investor opens their statement, they are already seeing the net performance of their investments there is no need to subtract these fees again. If you compare the different performance tables you will see the only difference in performance has to do with any costs associated with that specific share class.

Resources:

https://www.capitalgroup.com/individual/pdf/shareholder/mfgeqs-005_stat.pdf